Community Infrastructure Levy (CIL)

FAQ and useful links

1. How will my CIL be calculated?

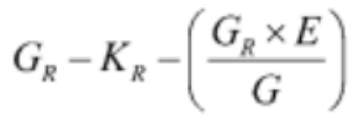

A: The rates are set in £/sqm for different development types. The total payable for any specific development will be calculated using the formula set out in CIL Regs Schedule 1 (former Regulation 40) of the CIL regulations 2010 (as amended), as follows:

- Multiply: Deemed Net Area chargeable at rate R (A) X CIL rate relevant to development type (R) X the index linked figured for the year planning permission was granted (Ip)

- Divide the total by the index linked figure for the year the charging schedule was implemented (Ic)

Deemed Net Area chargeable at rate R (A) = GIA of development type – Retained parts of in-use buildings (GIA of development type X Parts of in-use buildings to be demolished / Total GIA of the chargeable development)

The process for Deemed Net Area needs to be repeated for mixed use developments where the development types are charged at different CIL rates.

CIL rates are index-linked to reflect the change of price level since the CIL rates were adopted. Prior to 2020, the indexation was based on BCIS All-in Tender Price Index and since 2020 it has been based on RICS CIL Index. The latter is published annually in late October.

2. Will demolition works be included in the CIL calculation?

A: Where a development involves the demolition of existing buildings which take place between the time at which planning permission first permits development and the completion of the development, the demolished floorspace is credited against the CIL charge calculation, provided that:

Part of the building being demolished was in lawful use for a period of six consecutive months within the last three years prior to the time at which permission first permits development, eg for non-phased development, the date on which full permission is granted or the last reserved matter approved for outline permission. Otherwise, the demolished floorspace will not be included in the CIL calculation.

3. How do I calculate the GIA of a building?

A: Please use the Valuation Office Agency (VOA) Code of measuring practice.

4. How is CIL calculated for phased development?

A: Regulation 9(4) provides that each phase of a phased planning permission is a separate chargeable development for CIL purposes and therefore would be liable for separate payments for each phase, and each phase may benefit from the instalment policy.

The principle of phased delivery must be expressly set out in the planning permission. Southwark Council requires that all CIL phasing plan must be consulted with CIL team during planning application stage, and not as a last-minute add-on after Planning Committee.

5. When are surcharges and late interest charged?

A: CIL Regs 2010 (amended) provides that the council may impose the following surcharges/interest if the CIL process if not followed correctly:

|

Reason |

Regulation |

Amount of charge |

|---|---|---|

|

Failure to assume liability and the chargeable development has been commenced |

Reg 80 |

£50 each person liable to pay CIL |

|

The council is required to apportion liability, as the chargeable development has started and no one has assumed CIL liability |

Reg 81 |

£500 for each material interest |

|

Failure to submit a Notice of Chargeable Development and the chargeable development has been commenced (for development by way of General Consent) |

Reg 82 |

£2,500 or equal to 20% of the chargeable amount, whichever is the lower amount |

|

Failure to submit a commencement notice and the chargeable development has been commenced |

Reg 83 |

£2,500 or equal to 20% of the chargeable amount, whichever is the lower amount |

|

Failure of notifying a disqualifying event before the end of the period of 14 days beginning with the day on which it occurs (for exemption or relief claimants) |

Reg 84 |

£2,500 or equal to 20% of the chargeable amount, whichever is the lower amount |

|

Outstanding liability for late payment after the end of 30 days after the liability is due |

Reg 85 |

£200 or equal to 5% of the overdue amount, whichever is the greater amount |

|

Mandatory Late payment interest due from the date payment was due |

Reg 87 |

2.5% on the relevant amount above Bank of England Base Rate |

|

Failure to comply with any requirement of an information Notice after the end of 14 days beginning with the day the notice is served |

Reg 86 |

£1,000 or equal to 20% of the chargeable amount |

6. What are the consequences of persistent non-compliance with the CIL requirements?

A: Under Part 9 of CIL Regulations 2010 (as amended), the council may take more direction action to recover the amount due, for example the council may issue a CIL Stop Notice to prohibit development from continuing; and, after issuing a reminder to the party liable for the levy, apply to a magistrate’s court to make a liability order allowing it to seize and sell assets of the liable party.

In some cases where the council can demonstrate that recovery measures have been unsuccessful, it may apply to a magistrate’s court to send the liable party to prison for up to 3 months. If the council cannot recover CIL from the person who assumed liability, it can pursue the owners of the land.

Full details of enforcement actions against persistent non-compliance can be found in Part 9 of CIL Reg 2010 (as amended) and the planning practice guidance (Paragraph: 132 Reference ID: 25-132-20190901).

7. Can I appeal against the council’s decisions on CIL?

A: You can appeal against the council’s decisions on CIL, either on the charge itself or the enforcement actions, through the following routes:

1) appeal to the Valuation Office Agency (VOA) against a CIL charge, including the calculation of the chargeable amount, apportionment of a CIL charge between different landowners, decisions not to grant exemption for a residential annex and the calculation of the amount of the exemption for self-build housing. View PPG’s full guidance.

2) appeal to The Planning Inspectorate against a surcharge (Reg 17); any decision by the council where you disagree with the deemed commencement date given in the Demand Notice (Reg 118); or the issue of a CIL Stop Notice (Reg 119). View PPG’s full guidance.

8. Are there any supporting measures provided to developers for CIL payments during the COVID pandemic?

A: CIL Regulations 2010 was amended (in force between 22 July 2020 to 31 July 2021) to provide some flexibility for the council to defer payments, to temporarily disapply late payment interest and to provide a discretion to return interest already charged where they consider it appropriate to do so. These new amendments are intended to help small and medium sized developers with an annual turnover of less than £45 million, including the applicant’s linked and partnered businesses.

Southwark requires the following evidence in support of deferral applicant’s annual turnover:

- a declaration from a chartered accountant or auditor, which sets out what the turnover is and whether the business meets the criteria of sole enterprise or is part of a linked business or has partners

- information provided to Companies House including the company’s confirmation statement (annual return)

9. Besides compliance with CIL process, what should I be aware of before the development starts?

A: In addition to CIL requirements, pre-commencement planning conditions, set out in the decision notice issued when planning permission is granted, should be discharged before the development is commenced. Failure to comply with the CIL procedure (as described in Q5 and Q6) and discharge the pre-commencement conditions are both subject to enforcement actions.

Useful links:

Page last updated: 30 August 2024